Special Report

So far the 2022 tech stock crash is the biggest Yet… But the biggest drop is yet to come

Eleven Reasons the Stock Market is crashing:

- Rising inflation – too much money chasing a reduced number of goods due to supply chain disruptions.

- People plunging into more debt. Especially since their stock trading and retirement accounts have now wiped out.

- Covid pandemic (Continuing Lockdowns in China) still causing a global supply chain crisis.

- China’s economy is slowing down.

- The FED (the central bank of the US) starting to raise interest rates. Are about to panic.

- Energy crisis with record-high natural gas and rising oil prices. As the west shoots itself in the dick and tit with stupid sanctions.

- China cracking down on its biggest tech stocks (Alibaba, Ant, Tencent, and others)

- Increased government spending.

- War in Ukraine creating food shortages and higher food prices

- Potential war in Taiwan.

- Crypto crash. Erasing 2 trillion in highly liquid wealth.

Rising inflation

If the inflation rate continues to increase, it could negatively affect the stock market’s returns. Higher interest rates and lower economic growth would lead to lower dividends and lower stock prices.

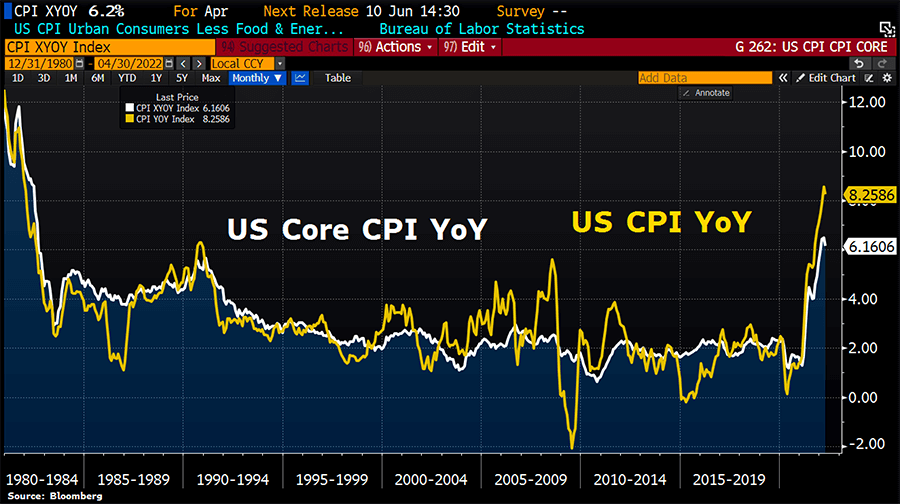

US inflation rate has risen 8.3% year-over-year. Even removing volatile food and energy prices, the so-called core CPI still rose 6.2%. During the pandemic, governments around the world pumped truckloads of money into their economies to boost the troubled economies. It was a short-term fix that caused the price to skyrocket. The added problem now is that the number of goods did not stay the same. Due to the supply chain crisis, the amount of goods decreased, thus deepening the inflation.

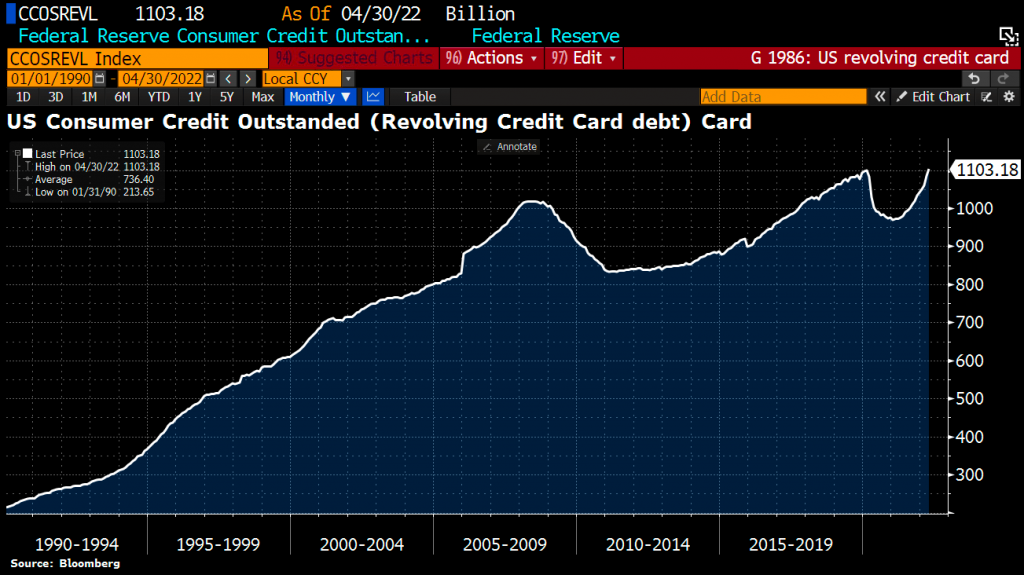

Americans increase credit card and Home equity debt

In a healthy situation, when the prices start to increase, people start to save money and limit their spending. What we see in June 2022 is a different picture – Americans dig deeper into credit card debt as inflation continues to rise. Credit card debt grew by 19.6% compared to a year earlier and totaled $1.103 Trillion in April 2022, surpassing the pre-pandemic record of $1.1tn.

Global debt keeps rising as well

People and companies are diving into more debt all around the world. Total Global debt to GDP hit a record high of 348% in the first quarter of 2022.

Large and small corporations need more and more debt to produce similar growth rates as they have been used to. This is another strong signal that the central banks around the world will have to raise the interest rates radically. Unfortunately, by raising interest rates they will also create a recession as small businesses won’t be able to borrow money for growth. Such a combination of high inflation and reduced spending leads to stagflation. Stagflation = inflation + stagnation.

Increased government spending

If the government has trouble paying its bills, it can be forced to borrow more money or increase the money supply through quantitative easing (QE) or other methods. The latter boosts inflation and makes interest rates drop, which leads to higher asset prices. If this goes on long enough, it may even lead to an economic crisis—and that’s when you’ll see a stock market crash! In other words, increased federal spending can lead directly from one thing to another until you end up with a bubble, and then eventually all hell breaks loose as stocks tumble down their respective cliffs into oblivion. The federal government stimulus program has created an enormous amount of debt and inflation. The problem with high levels of debt and inflation is that they lead to higher interest rates, lower growth, and even a recession. That’s right: even if your investments grow 10% per year instead of 5%, your wealth won’t increase very much at all because these investments will be worth much less when adjusted for inflation over time—and who wants that?

Energy crisis

Many countries have adopted new greeneeewinieee energy laws… For example, England shut down North Sea gas production, The US shut down critical pipelines and production from proven oil and gas fields. Germany has shut down most of its Nuclear power plants with the idea that they will gradually move to renewable energy sources. Unfortunately, it doesn’t happen so fast. So in the meantime, they have to use coal and gas, thus driving the demand and price for gas up. Pair it with the fact that China has cut its use of coil and turned to gas (which is significantly cleaner)… …then add the fact that Russia is cutting its gas supplies to Europe as a form of blackmail…

The war in Ukraine

Whenever there is a large military conflict or just a threat of one, investors start to move their assets away from stuff like stocks into safer assets like gold or government bonds. As they sell their tech stocks, the prices of those stocks go down.

The potential war in Taiwan

There have been many signals that China might be considering invading Taiwan already in the autumn of 2022. Big investors are not waiting for it to happen and are taking out their assets from the stock market before it happens. Why? Because such military conflict would likely spill out creating a logistical paralysis for all Chinese<>Western goods. Also because Taiwan is the biggest producer of microchips and a war there would create a shock across all the markets, as everything runs on microchips.

Conclusion

The stock market is a war fought with money instead of bullets. The market has already fallen quite a bit, but nobody knows how far we are from the bottom before the market turns bullish again. Predicting the market bottoms is the hardest thing there is. But my job is to try to do hard things.

I fell into the Bull trap. I shorted correctly on the low expecting a further drop on May 20th around 11500 on the NASDAQ 100. The quick sharp upside reversal to 12900 fooled me. The bull trap. The drop to 11257 confirms my initial instincts were right. We lost a lot of money. I am now setting us up for the next leg down, which I believe has already started. This next move if we get it is called called capitulation. This should be the biggest drop yet. And IF i can guess lucky it could be worth millions. And if i guess wrong it will wipe out the account. In other words its all on the line.

Comments

You must be logged in to post a comment.