Trump “We think we hit them so hard and so fast, they didn’t get to move,”

Trump for over a month told them he would attack… Was NOT a surprise

Trump told reporters in a news conference at a NATO summit. “If you knew about that material, it’s very hard and very dangerous to move… They call it ‘dust,’ but it’s very, very heavy.”

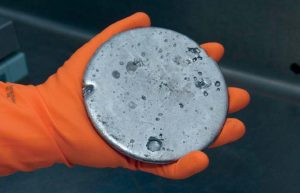

Its a big hockey puck. And light enough to pick up with a rubber glove

Trump “And they were way down. You know, they’re 30 stories down. They’re literally 30 to 35 stories down in the ground.”

Dah! they have loading docks and cargo elevators…. actual picture from Fordo

” It’s very, very hard to move.” Really just put it in a few pickup trucks

Actual enriched hockey pucks

Joseph Cirincione, a nuclear nonproliferation expert and former vice chair of the Center for International Policy, Said Iran could have moved its enriched uranium with just “three or four trucks.”

Actual trucks at the Fordo loading bay days before Trumps reality TV show live bombing of Fordo episode