Radio Free Wall Street

CRASHED MOON SHOT

January 30, 2026

Top News Stories

GRAB THE MONEY

January 29, 2026

Top News Stories

CAVE DWELLER

January 28, 2026

Top News Stories

THE HEAD OF THE SNAKE

January 19, 2026

Breaking News

WAR NO WAR

January 15, 2026

Breaking News

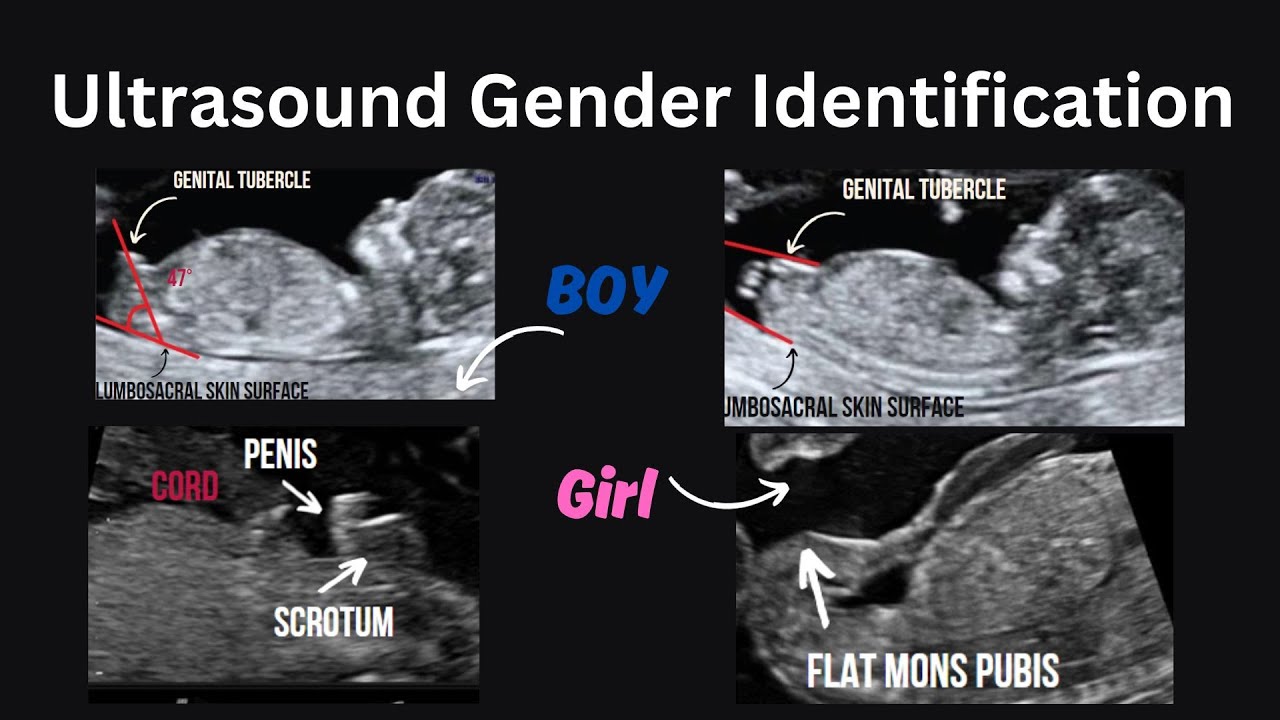

HOW TO FIND THEIR SEX

January 14, 2026

Special Report

Iran intensify their crackdown on anti-government demonstrations

January 10, 2026

- Revolutionary Guards declare security a ‘red line’

- Iranian military says it will protect public property

- 100 people reported arrested in town near Tehran

- Rubio says US supports ‘the brave people of Iran’

- State media broadcasts footage of funerals of security forces

DUBAI, Jan 10 – Iran’s authorities indicated on Saturday they could intensify their crackdown on the biggest anti-government demonstrations in years, with the Revolutionary Guards blaming unrest on terrorists and vowing to safeguard the governing system. A day after U.S. President Donald Trump issued a new warning that the United States could intervene, there were fresh reports of violence across the country, although an internet blackout made it difficult to assess the full extent of unrest. The exiled son of Iran’s last shah, who has emerged as a prominent voice in the fragmented opposition, made his strongest call yet for the protests to broaden into a revolt to topple the clerical rulers.

State media said a municipal building was set on fire in Karaj, west of Tehran, and blamed “rioters”. State TV broadcast footage of funerals of members of the security forces it said were killed in protests in the cities of Shiraz, Qom and Hamedan. Footage on social media on Friday showed large crowds gathered in Tehran and fires lit in the street at night. Reuters was able to confirm the location by comparing landmarks with satellite imagery.

Protests have spread across Iran since December 28, beginning in response to soaring inflation, and quickly turning political with protesters demanding an end to clerical rule. Authorities accuse the U.S. and Israel of fomenting unrest. A witness in western Iran reached by phone said the Revolutionary Guards (IRGC) were deployed and opening fire in the area from which the witness was speaking, declining to be identified for safety.

The semi-official Tasnim news agency reported the arrest of 100 “armed rioters” in the town of Baharestan near Tehran. In a statement broadcast by state TV, the IRGC – an elite force which has suppressed previous bouts of unrest – accused “terrorists” of targeting military and law enforcement bases over the past two nights. It said several citizens and security personnel had been killed and public and private property set on fire.

Safeguarding the achievements of the Islamic revolution and maintaining security was a “red line”, it added.

The regular military also issued a statement saying it would “protect and safeguard national interests, the country’s strategic infrastructure, and public property”.

Trump said on Thursday he was not inclined to meet Pahlavi, a sign that he was waiting to see how the crisis plays out before backing an opposition leader. Trump, who joined Israel to strike Iran’s nuclear sites last summer, warned Tehran last week the U.S. could come to the protesters’ aid. On Friday, he said: “You better not start shooting because we’ll start shooting too.”

“I just hope the protesters in Iran are going to be safe, because that’s a very dangerous place right now,” he added. A doctor in northwestern Iran said that since Friday large numbers of injured protesters had been brought to hospitals. Some were badly beaten, suffering head injuries and broken legs and arms, as well as deep cuts. At least 20 people in one hospital had been shot with live ammunition, five of whom later died. On Friday, Khamenei accused protesters of acting on behalf of Trump, saying rioters were attacking public properties and warning that Tehran would not tolerate people acting as “mercenaries for foreigners”.

NN: If the Ayatollahs fall Iran oil will zoom past $100.

By the way Khamenei has made a contingency plan to exile himself in Russia.

Breaking News

GOAT ROPE

January 9, 2026

Special Report

Up Up and Away

January 6, 2026

Breaking News

On The Way To SuperMax

January 3, 2026